Standard Ethics is a Self-Regulated Sustainability Rating Agency that issues extra-financial sustainability ratings, providing independent assessments compared to the main international sustainability guidelines issued by the UN, OECD, and EU.

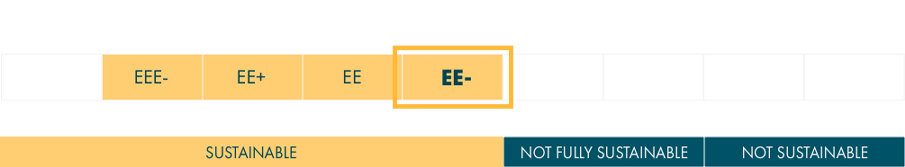

In February 2026, the agency issued the Group's first Corporate Standard Ethics Rating (SER), assigning a rating of "EE-" (Adequate) and a Long-Term Expected Rating of "EE+" (Very Strong).

The Standard Ethics rating recognises the Bank's progressive alignment with the international guidelines of the UN, OECD, and EU, supported by structured sustainability governance and adequate ESG reporting and disclosure. The assessment highlights the presence of a structured ESG Risk Management process and a Sustainability Plan integrated into the 2025-2027 Strategic Plan aimed at reducing environmental impacts within a balanced and coordinated governance system between the Parent Company and Affiliated Banks. The Group's corporate structure has a positive impact on its local roots and on the attention paid to stakeholders and social issues by the Parent Company and Affiliated Banks in their respective areas of competence.

The results of the assessment are presented in the Final Report, which details the criteria and elements taken into consideration for the purpose of assigning the rating.

For further information: www.standardethics.eu

Morningstar Sustainalytics is a leading ESG research, analysis and rating company that supports investors worldwide in developing and implementing responsible investment strategies.

Morningstar Sustainalytics ESG Risk Rating is a tool that assesses the risk associated with environmental, social and governance (ESG) factors for companies and organisations. The assessment provides insight into how a company addresses and manages risks and opportunities arising from ESG factors, which can significantly influence its long-term performance.

The evaluation of our Group

The Cassa Centrale Group obtained an ESG Risk Rating score of 16.6, an improvement on the previous score of 17.1, confirming its position in the 'Low Risk' category, which indicates a reduced level of risks of suffering significant financial impacts from ESG factors.

Under no circumstances may the ESG risk rating be interpreted as investment advice or expert opinion as defined by applicable legislation.*

*Copyright©2023 Morningstar Sustainalytics. All rights reserved. This section contains information developed by Sustainalytics (www.sustainalytics.com). Such information and data are proprietary of Sustainalytics and/or its third party suppliers (Third Party Data) and are provided for informational purposes only. They do not constitute an endorsement of any product or project, nor an investment advice and are not warranted to be complete, timely, accurate or suitable for a particular purpose. Their use is subject to conditions available at https://www.sustainalytics.com/legal-disclaimers.

The initiative is a collaboration between Fondazione Finanza Etica and Rete Italiana Pace e Disarmo.

ZeroArmi analyses the degree of involvement of the banking system in the military sector, emphasising transparency and critical dialogue with banking institutions.

The results of the project are presented in a dedicated report, thus being the first tool to assess Italian bank exposure to the arms industry.

An achievement consistent with our values and the Group's strategic choice to have a Policy governing arms brokering.