Aifin, Associazione Italiana Financial Innovation, nell’ambito dell’annuale Financial Innovation - Italian Awards 2020, ci ha assegnato il terzo posto assoluto nella categoria CSR e Sustainability con il progetto “La strategia di marketing e comunicazione del Gruppo Cassa Centrale in tema CSR”.

Tra gli aspetti del progetto considerati maggiormente innovativi è stata evidenziata una strategia di comunicazione originale e la messa a disposizione di tools di comunicazione per tutte le banche del Gruppo volti alla valorizzazione della DNF - Dichiarazione Consolidata di Carattere Non Finanziario 2019.

Tale importante riconoscimento premia e valorizza uno degli ambiti più rilevanti per il nostro posizionamento di banche cooperative sui territori, la forza e la solidità del Gruppo.

The Consolidated non-financial statement covers a period during which many of our certainties have been called into question.

An unknown, invisible virus has suddenly invaded our lives, inflicted suffering and tension, upended our routines and generated a completely new situation all over the world. The contagion struck particularly hard in certain areas where our Group has the strongest presence. We acted immediately, rushing to the front lines to provide a swift response.

In terms of our organisation, health and safety, the protection of People, and even more so in supporting Communities, we have been doing our part and strive to continue to do so.

In line with our territorial positioning and characteristically local focus,we identified concrete support measures for Communities that enable households and businesses in difficulty to obtain specific moratoria on outstanding mortgages. Along with the initiatives coordinated by Cassa Centrale, the Group Banks were involved in providing specific credit facilities with dedicated funds and subsidised conditions as well as direct donations, fundraising activities and other initiatives, working on multiple fronts to ensure that the Group would contribute to meeting the needs arising throughout the country, in order to overcome this difficult situation.

And our work will continue, even in any upcoming situations that may arise.

On 31 December 2019, the first year of operations of the Cassa Centrale Banca - Credito Cooperativo Italiano Cooperative Banking Group (hereinafter, the “Group” or the “Cassa Centrale Group”) came to an end. The launch of the Group marked the end of the transitional phase of a reform process lasting nearly 4 years, which involved every part of the system, profoundly revising the roles, duties and responsibilities of the structures serving the Cooperative Credit Banks, Rural Banks and Raiffeisenkassen. This has given rise to a structure which, at the regulatory and organisational level, is unique throughout Europe.

In its first year of operations, it engaged in continuous dialogue to seek to identify the right balance between the independence of many cooperative Banks with strong roots in their Communities and the synergies arising from being part of a Group, with the gradual convergences that the search for economies of scale brings with it. Some significant examples of this are the profound reorganisation in Bank services, which took shape in early 2020 with the birth of Allitude, constant growth in volumes and the quality of the services of the subsidiaries Assicura and NEAM, and the progressive enhancement of the potential of Claris Leasing and Centrale Casa.

While maintaining a balance between the independence of the Banks and the synergies deriving from being part of a Group, we strive to enhance and further sharpen our focus on the Territories, in line with our values, performing that social function which the Constitution attributes to Cooperation.

We feel a deep responsibility to guarantee the continuity and development of the extraordinary wealth represented by Cooperative Credit, actively collaborating to improve the moral, cultural and economic conditions of our Communities, as laid out in the Articles of Association of the Group’s Cooperative Credit Banks, Rural Banks and Raiffeisenkassen. The Board of Directors, most recently appointed in early 2019, worked intensely and in full collaboration with the Management and the business structure.

In March 2020, the strategic guidelines for our Group’s development were defined, based on the following pillars:

- proximity and vicinity to the Communities, households and SMEs in the reference Territory, leveraging the widespread presence and strong local roots of the Group Banks;

- a focus on understanding needs, including by taking a proactive approach, adopting adequate instruments to support commercial processes throughout the entire customer service lifecycle;

- simplicity and convenience of the offer based on appropriate solutions and balanced products, suited to our Partners and Customers, with pricing that favours transparency and the overall profitability of the relationship over time;

- banking leadership driven towards a gradual reinforcement and extension of the Customer base in areas of lower presence, leveraging an evolving branch concept, multichannelling and innovative technological solutions.

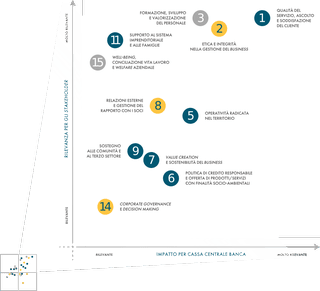

In defining our strategic objectives, sustainability topics were also taken into consideration, as part of a path that promotes cooperative Values, a distinctive and unifying feature of the Cassa Centrale Group. In this context, several initiatives already launched have continued, as described in the Statement: first and foremost, the multiple initiatives focusing on the Territories, which in 2019 saw more than 22 thousand actions including charitable activities and sponsorships, for a total value of more than EUR 27 million.

We are a Group that strongly believes in our territorial and mutualistic vocation.

Cassa Centrale will guarantee the circularity of best practices between the socially and environmentally relevant initiatives put into place by the Banks, with a view to always best enhancing our specific features. We intend to promote concrete initiatives while spreading the culture and value of sustainability to Employees and Communities. We will do this through direct actions, such as purchasing electricity from renewable sources, and raising the awareness of our Partners and Customers: promoting investments in the sustainable segments of our NEF fund and paying particular attention to the environmental and social impact of our loans.

The focus on People - Partners, Customers and Employees - is now and will always remain at the very heart of our actions.

"We feel a deep responsibility to guarantee the continuity and development of the extraordinary wealth represented by Cooperative Credit. The new form of the Cassa Centrale - Credito Cooperativo Italiano Group confirms and reinforces our desire to work alongside our territories, and to actively cooperate with them for the improvement of the moral, cultural and economic conditions of our Communities"

Together, we have built a Group to continue to create shared wellbeing and bring an original development model to life, in which difference is a value and local identity a principle.

Declared in Art. 2 of the Articles of Association of the Group Banks, our social, cultural and economic goals signify our sustainable nature which we have linked to the Goals of Agenda 2030. Founded on values of cooperation, mutuality and local presence, we will continue to contribute towards creating the common good.

Collaboratori

Fornitori

Valore

economico

trattenuto

dal sistema

di impresa

Stato, enti e

istituzioni, comunità

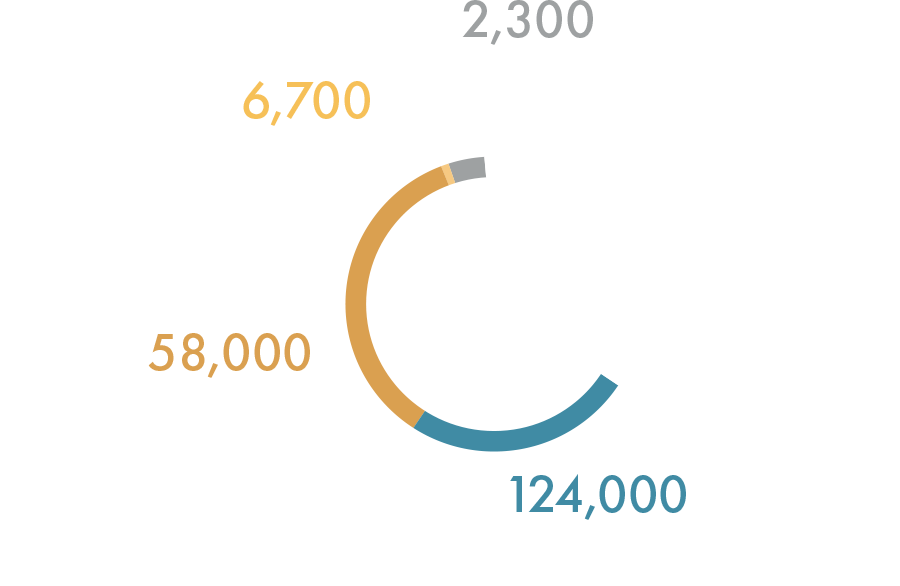

La creazione di valore economico sostenibile nel tempo e per il territorio è l’obiettivo primario del Gruppo in quanto condizione indispensabile per remunerare tutti gli stakeholder

With the aim of ensuring a suitable offer, the Group structures and continuously updates a portfolio of products and services identified and developed in response to the principles governing Cooperative Credit.

The offering is intended for the Group Banks as well as Customer Banks, households and businesses through the services of Cassa Centrale Banca and the Group Companies.

Support for businesses, households and individuals

“The Group’s offering favours the development of the socioeconomic fabric of our country, providing differentiated and innovative banking and financial products capable of meeting the needs of customers and facing market challenges. Through a system of Banks strongly rooted in their local Territories, the Group is able to meet all of the typical needs expressed by households and businesses”.

Support for Banks

Reliability, operational efficiency, innovation: so that the Group Banks and Customer Banks can handle market challenges, we provide quality brokerage services and a broad range of innovative investment solutions consistent with customer requirements.

Responsible credit and finance

Investing in respect for people’s rights and the environment. I would use the leaflet chart.

Care for the Customer

Firm rules, clear and defined skills and responsible conduct are the foundations for safeguarding the Customer.

In relations with Customers, less tangible elements are also fundamental, for example the transparency of contractual conditions, speed and clarity in receiving information, compliance with the conditions of privacy necessary to guarantee efficient and respectful management of their needs.

Partners

The value of shared wellbeing

We are the first Cooperative Banking Group born in Italy. We are Banks made of People, who put other People at the heart of what they do: we pay particular attention to the offer to Cooperative Partners of services that best meet their lifecycle requirements, so we can make a concrete contribution to the economic, social and cultural development of local Communities.

Natural

person

Businesses and

Associations

TERRITORY

Local presence

Roughly 23% of branches are located in Municipalities with a population of under 3,000, compared to 9% of other banks, and in 313 Municipalities the Group is the only banking presence.

RELATIONSHIPS

Cooperation

Relations based on constant dialogue and active engagement with its stakeholders confirm the Group’s responsibility towards its territory of operation.

LOCAL COMMUNITIES

Contribute

We place value on all initiatives in the Communities of which we are part, because it is from value that shared wealth and wellbeing spring forth.

![]()

Social/assistance activities

![]()

Culture, training and

research

![]()

Promotion of the territory

and economic entities

![]()

Sport, recreation

and aggregation

![]()

Initiatives in favour

Partners

ENVIRONMENT

The environment, the most important common good

Embracing the values of Sustainability and Responsibility for us also means protecting environmental resources.

We know that to make a concrete contribution to the wellbeing of Communities, it is necessary to actively protect the environment. Our commitment includes a series of initiatives with which we intend to create and raise awareness concerning development that works in tandem with low environmental impact.

The daily work of more than 11 thousand People represents a great value for our Group: every day, with passion and spirit of collaboration, they meet the needs of Partners and Customers, building with them a relationship of trust, awareness and attention for the origins of our way of banking.

Donne e Uomini di valore legati alle proprie Comunità,

che credono e si impegnano giorno dopo giorno nello sviluppo del Territorio secondo i principi della Cooperazione.

Tecnico specialista

Altro

Salute e sicurezza

Induction

Manageriale

Riconosciamo e valorizziamo il potenziale delle nostre Persone, tutelandone innanzitutto la salute e la sicurezza nei luoghi di lavoro e svolgendo piani di formazione anche in partnership con le Università, canale fondamentale per l’inserimento di giovani neo-laureati: nel 2019, 300 nuovi collaboratori avevano meno di 30 anni – a fronte dell’età media di 44 anni.

As a Group, we acknowledge the importance of operating in accordance with the principles of lawfulness, morality, professionalism, integrity, and transparency, consistently with our business goals. This is why Cassa Centrale and the Group's Banks have adopted the first 4 sustainability policies.

Anticorruption Policy

The Anticorruption Policy outlines the Policy adopted by the Group to inspire, govern, and pre-emptively monitor standards of behaviour so as to mitigate the risk of violations of anticorruption laws.

Environmental Policy

The Environmental Policy outlines the Policy adopted by the Group to inspire, govern, and pre-emptively monitor the standards of behaviour expected of employees with respect to the environment. The Group promotes the well-being of the local community and its economic, social and cultural growth through “socially responsible” operations, and its business goals include pursuing the creation of value for all its stakeholders.

Human Rights Policy

The Human Rights Policy outlines the Policy adopted by the Group to inspire, govern, and pre-emptively monitor the standards of behaviour expected of employees with respect to fundamental Human Rights and basic working conditions to help create sustainable value for all stakeholders in the long term.

Diversity Policy

The Diversity Policy outlines the Policy adopted by the Group to inspire, govern, and pre-emptively monitor the standards of behaviour expected of employees with respect to diversity, inclusion, and equal opportunity in the workplace.

Arms Dealing Policy

The Arms Policy describes the Policy adopted by the Group to inspire, govern, and preemptively monitor practices as part of our operations in compliance with the law and in accordance with the spirit of ethics, fairness, professionalism, integrity, and transparency that is the hallmark of the Group.

Letter from the Chairman Download pdf

CCB and the 2030 agenda Download pdf

Sustainability Summary (Italian version) Download pdf

Consolidated Non-Financial statement 2019 Download pdf

Complete document archive Read more